Overview of the Swedish gambling market

In 2023, Sweden’s regulated gambling market reported a net turnover of SEK 27.1 billion, showing a slight decrease from SEK 27.4 billion in 2022. This decline is largely due to a reduction in land-based gambling, while online gambling continues to lead the market.

Online gambling’s growing dominance

The online gambling sector is now the largest segment within Sweden’s gambling industry. In the first quarter of 2024, online gambling accounted for about 63.6% of the total gambling revenue, generating SEK 4.2 billion. This trend demonstrates the increasing preference among Swedes for digital gambling platforms.

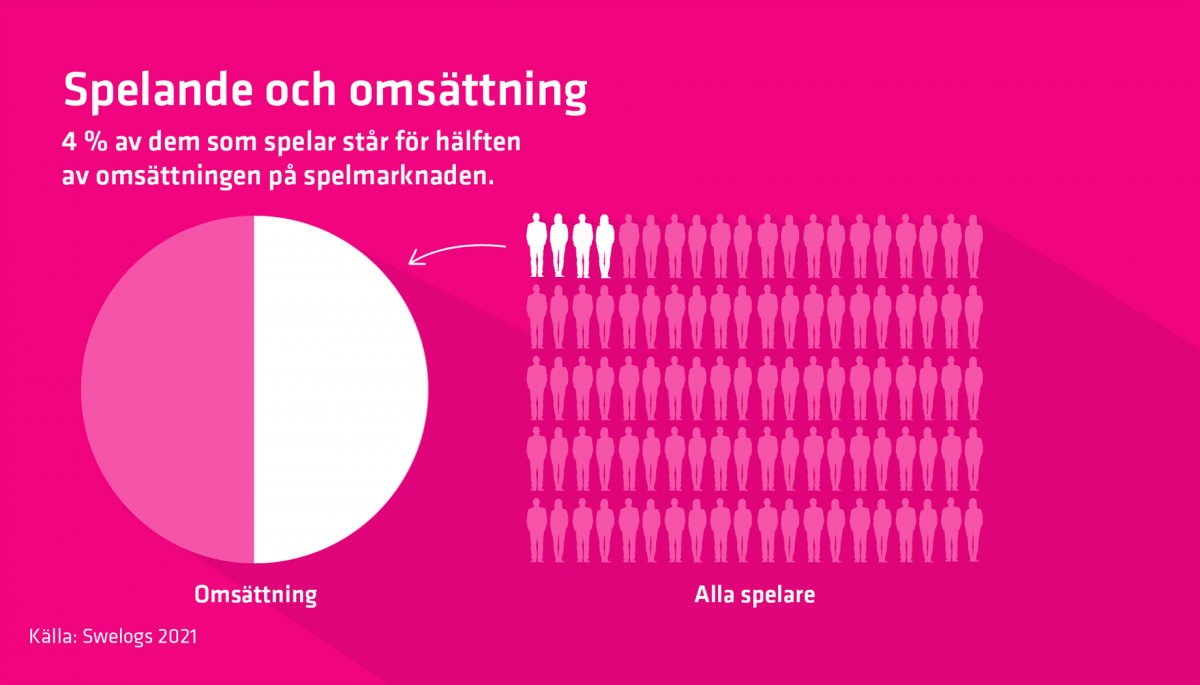

Concentration of gambling expenditures

A significant portion of gambling expenditures is concentrated among a small group of players. Data indicates that 4% of gamblers account for 50% of the total market turnover. This concentration suggests the need for targeted interventions to address potential gambling-related issues within this demographic.

Impact of problem gambling on specific games

Certain gambling activities are more closely linked to problem gambling behaviors. Studies reveal that approximately 75% of the money wagered on slot machines and casino games comes from individuals identified as problem gamblers. In contrast, only 9% of lottery revenue comes from this group. These statistics imply that specific gambling formats may require more focused regulatory oversight to mitigate associated risks.

Per capita gambling losses

On average, each Swedish adult lost about SEK 3,200 on regulated gambling activities in 2023. Among those who participated in gambling over the past year, the average loss increased to nearly SEK 5,800. These figures highlight the financial impact of gambling on individuals and households.

Historical growth of the gambling market

From 2006 to 2023, the Swedish gambling market saw significant growth, with net turnover rising from SEK 15 billion to SEK 27.1 billion. This expansion reflects both the increasing popularity of gambling and the evolution of the market, especially with the rise of online platforms.

Regulatory landscape and future considerations

The re-regulation of Sweden’s gambling market in 2019 introduced a licensing system to enhance consumer protection and promote fair competition. Despite these measures, challenges persist, including the need to address unlicensed operators and the high concentration of gambling expenditures among a small population segment. Ongoing monitoring and adaptive regulatory strategies will be essential to maintain a balanced and responsible gambling environment in Sweden.